Mortgage rates fall as labor market normalizes

Housing Wire

MARCH 8, 2024

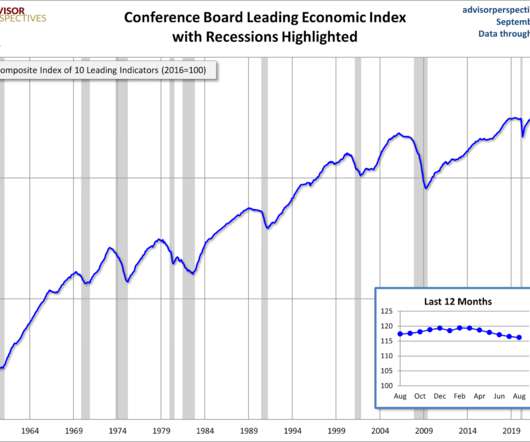

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. The four-week moving average declined slightly by 750, to 212,250 Below is an explanation of how we got here with the labor market, which all started during COVID-19. Today, we are at 157,808,000.

Let's personalize your content