Are we seeing a mortgage rate lockdown?

Housing Wire

SEPTEMBER 13, 2022

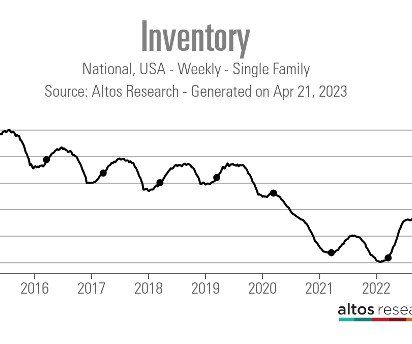

The premise of a mortgage rate lockdown is simple: so many American households have such low mortgage rates that some will never move once rates rise, which then locks up housing inventory. Typically we have a natural set of new listings each year; inventory rises in the spring and summer and then falls in the fall and winter.

Let's personalize your content