Housing inventory falls under 1M again as sales collapse

Housing Wire

JANUARY 20, 2023

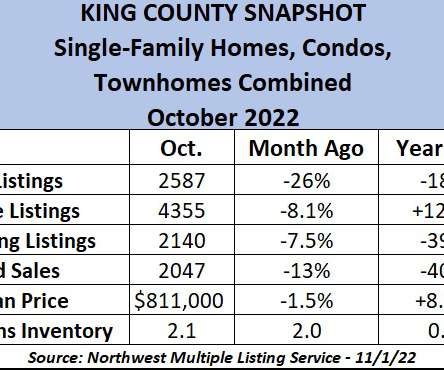

On Friday NAR reported that total housing inventory levels broke under 1 million in December, dropping to 970,00 units for a population of 330 million people. million in January down to about 4 million in December, We now have total inventory levels near all-time lows again. Unsold inventory sits at a 2.9-month months in Nov.

Let's personalize your content