What will housing credit look like in next recession?

Housing Wire

MARCH 30, 2023

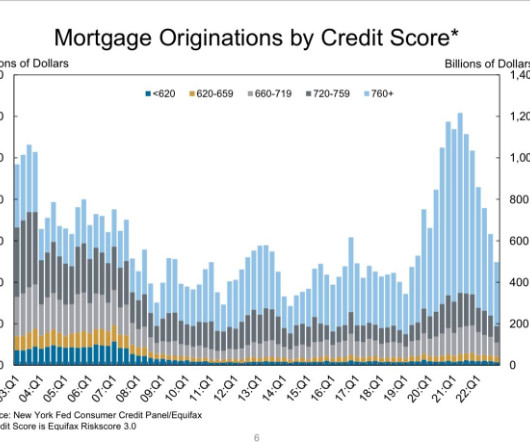

With the banking crisis spurring more talk of a recession, the question now is: What would housing credit look like in a recession? housing market would crash during the pandemic. One of the main reasons for that fear was that housing credit was about to get tight, meaning fewer people could buy homes with mortgages.

Let's personalize your content