How home-price growth has damaged the housing market

Housing Wire

JUNE 28, 2022

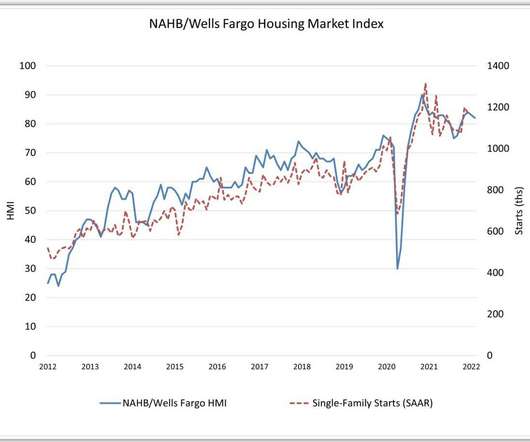

This data line lags the current housing market as it’s a few months old. I developed a specific home-price growth model for the years 2020-2024 which said that if home-price growth grew at 23% for five years we would be fine, with total housing demand —both new and existing homes together — getting to 6.2

Let's personalize your content