Balance to Return to the Housing Market

Appraisal Buzz

NOVEMBER 18, 2021

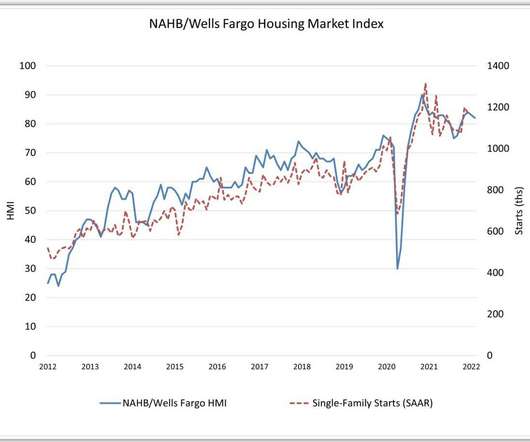

After a torrid start to the year, home price appreciation will slow, and new construction will replenish the nation’s inventory in the second half of 2002. The post Balance to Return to the Housing Market appeared first on DSNews. The post Balance to Return to the Housing Market appeared first on Appraisal Buzz.

Let's personalize your content