Where’s the bottom for new home sales?

Housing Wire

OCTOBER 26, 2022

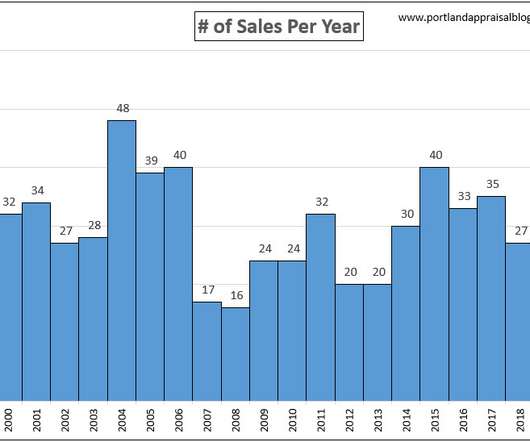

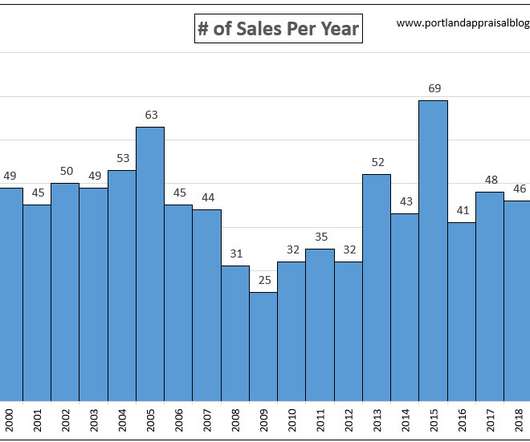

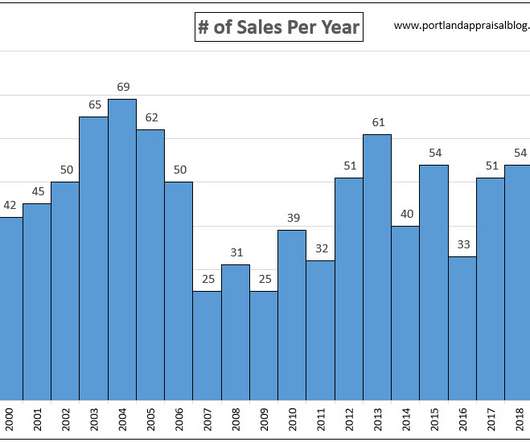

New home sales are now below the recession levels of 2000 and have fallen all the way to 1996 levels, when interest rates were near 8%. Census Bureau and the Department of Housing and Urban Development. The builders will pull back on construction when the supply is 6.5 months of supply is still under construction 2.1

Let's personalize your content