AppraisalWorks™, Clear Capital Announce Partnership to Streamline Appraisal and Valuation Review for Lenders

Clear Capital

NOVEMBER 3, 2022

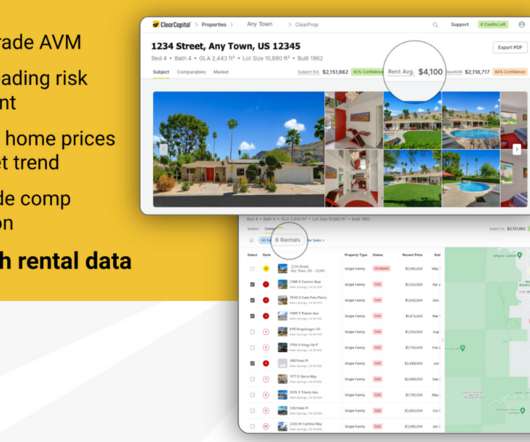

AppraisalWorks , Clear Capital Announce Partnership to Streamline Appraisal and Valuation Review for Lenders. Banks, credit unions, loan servicers and mortgage lenders now have access to a suite of tech-enabled products for property valuation.

Let's personalize your content