What does the new normal for first-time homebuyers look like?

Housing Wire

SEPTEMBER 21, 2022

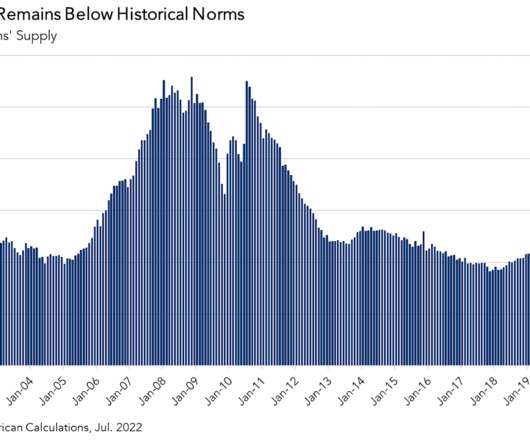

Buyers and sellers alike have now anchored their expectation of “normal” to sub-3% mortgage rates, multiple-offer bidding wars, and double-digit annual price growth. Compared with the fourth quarter of 2021, the homeownership rate in the second quarter of 2022 for households under 35 years old increased by 0.8

Let's personalize your content