Lower mortgage rates are stabilizing the housing market

Housing Wire

DECEMBER 7, 2022

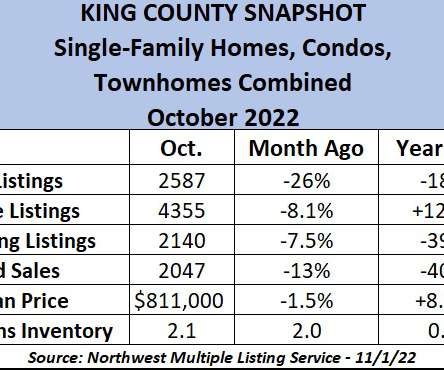

Now, with five weeks of data in front of us, we can say they have stabilized the market. As you can see from the chart above, the last several years have not had the FOMO (fear of missing out) housing credit boom we saw from 2002-2005. Since 2013 I have said that mortgage rates over 5.875% would be problematic to housing.

Let's personalize your content