Housing inventory falls under 1M again as sales collapse

Housing Wire

JANUARY 20, 2023

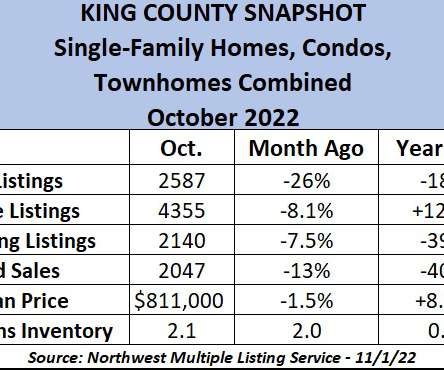

housing market , we just experienced an event that most people never thought could happen. The Federal Reserve wanted a housing reset , and it got a housing recession, with activity falling the fastest since the brief pause during COVID-19. During that period, we saw new listing data decline.

Let's personalize your content