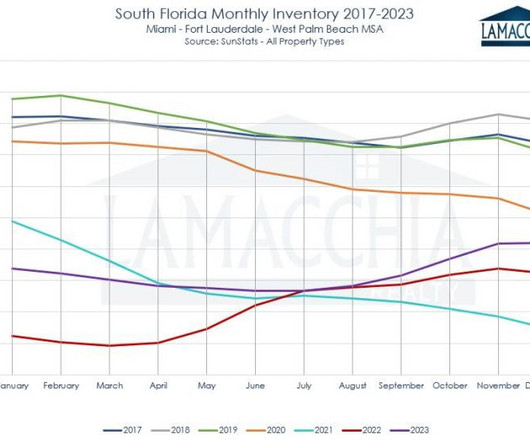

Housing inventory defied all predictions in 2023

Housing Wire

DECEMBER 30, 2023

Since I believe most home sellers are also homebuyers, once new listings created a new low level after mortgage rates reached over 6% in 2022, it added another layer of home demand falling off a cliff. What we want to see in 2024 is new listing data growing in the spring season. Weekly inventory change (Dec.

Let's personalize your content