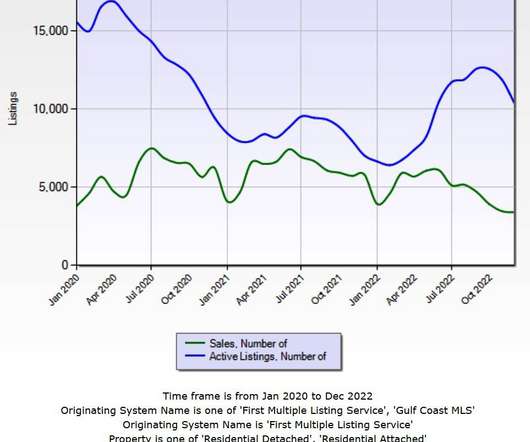

As home prices increase, sellers have the upper hand

Housing Wire

OCTOBER 7, 2020

points, but has recovered more than half of its early pandemic-period decline when April’s HPSI hit its lowest reading since November 2011. August’s HPSI survey revealed both a confident seller’s and buyer’s market, however, Fannie Mae reported September buyers showing more hesitancy. Presented by: NAMB. As of Oct.

Let's personalize your content