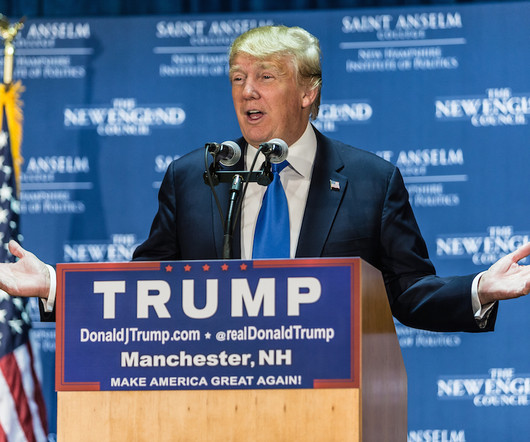

HomeServices settles commission lawsuits for $250M

Housing Wire

APRIL 26, 2024

HomeServices of America , the last remaining brokerage defendant in the landmark Sitzer/Burnett antitrust commission case , has agreed to pay $250 million in damages to settle lawsuits that will change agent compensation across America. The New York Times first reported the story. The deal comes just days after the federal judge overseeing the commission case in Missouri approved a preliminary settlement that will see the National Association of Realtors and multiple other residential brokerages

Let's personalize your content