The standoff between homebuyers and sellers

Housing Wire

OCTOBER 11, 2022

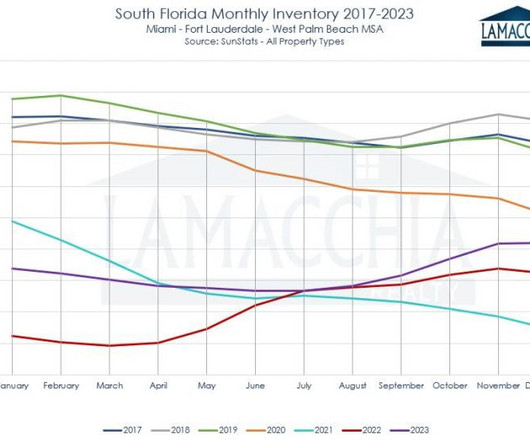

There’s a showdown at the housing market corral between homebuyers and sellers. million active listings, but at just 1.28 The only time this happened was 2006-2011 — the housing bust years. Home prices ebb and flow, pricing was working in the sense that sellers met homebuyers to a degree. million today.

Let's personalize your content