How to Sell Your House for a Job Relocation

Explore your options for moving on from your old home to life in your new city.

You’ve been offered a new job — great! But it’s in another city. And you own your home.

While you may be excited about the career opportunity and the chance to relocate somewhere new, there are so many hurdles to jump over between the day you get the offer letter and finally being settled in your new city, with all the loose ends tied up. Before you make any decisions, make sure you review the options you have for dealing with your current house.

Relocation package negotiation

Approximately 70% of US companies offer relocation incentives for employees or new hires. So, if you haven’t heard anything about what your new employer is willing to offer in terms of relocation, make sure to ask for more information.

And, just like the job offer itself, your new job relocation package is negotiable, so speak up and make sure you agree on something that’s a good solution for you and your financial needs.

Standard relocation package

The most commonly covered costs include moving expenses (including the services of a professional moving company and packing supplies), temporary housing in your new city, transportation costs, a trip to the new city to search for housing, storage costs, and vehicle relocation.

Down-payment assistance

A less common but generous feature of some relocation packages is down-payment assistance, where the company pitches in to provide some money for a down payment on a new home in the city where you’re moving. This can be especially helpful if you’re moving into a more expensive area or if you don’t have much equity in your current home.

Relocation home buyout

The holy grail of relocation offerings, in this situation the relocation company your employer uses will essentially buy your house from you (sometimes only after it is listed on the market for a period of time), using two independent appraisal results to find a fair price. While this option is typically only extended to highly sought-after or senior employees, if it’s offered you may want to take advantage of it, as it removes much of the risk associated with the buying and selling process.

Evaluating the selling market

In most relocation situations, your goal is to sell the home you’ll be leaving as quickly as possible — it’s a lot to juggle selling a home from afar while adjusting to the demands of a new job.

But you also want to do your research on the state of your local real estate market. The insights you’ll gain will help ensure you can sell your house quickly and at a price you’re comfortable with.

Hire an agent

If you’re asking yourself what to do when selling your house, start by hiring a local real estate agent. Given that you’re trying to sell your house quickly, find an agent with plenty of experience — one who knows the process and can create a selling strategy that works.

Determine the market trends

How fast you sell your home and how much you’ll be able to sell it for depend on many factors, but the state of your local market plays a big role. If you’re in a buyers market, where many listings are competing for few buyers, it may take you longer to sell. If you’re in a sellers market, you’ll likely sell more quickly, as there are many buyers competing to submit the winning bid on a limited inventory of homes.

Consider CMAs

A CMA is a comparative market analysis. Put simply, it’s a report your real estate agent puts together for you that looks at the average sales price of similar homes and the amount of time homes are sitting on the market. A CMA can be a valuable tool in setting both your price and your timeline.

Is it a good time to sell?

Take into consideration feedback from your agent, market trends, and your comparative market analysis, then decide if it’s the right time to sell. Are homes selling fast? Is it a sellers market? Are you going to make enough money on the sale to buy the new home you want?

Option 1: Prepare to sell your house

Especially if this is your first time selling, you may be asking yourself, “What do I have to do to sell my house?” Consider these standard to-do’s.

Get an inspection done

Many sellers are paying to do their own inspection before listing. While your buyer will probably do another one as part of the buying process, it’s nice to know ahead of time about any major repairs that need to be completed, or any red flags that will cause a potential buyer to lower their offer.

Spruce things up

Your home’s curb appeal is your one and only first impression, so take some time to clean up your landscaping. Additionally, do any touch-ups inside the house that you’ve been putting off.

Take professional photos

In order to be competitive, you’ll want to have professional real estate photos taken. They typically cost a few hundred dollars, and they’ll help highlight your home’s best features.

Staging

Staging your home can be as simple as decluttering and repositioning furniture, or as involved as hiring a professional stager. Either way, it’s a great way to help buyers picture themselves living in the home.

Open houses

Talk to your real estate agent about his or her plans for holding open houses. They’re a great way to get a lot of foot traffic through your home, and the more people who see your home, the more likely you are to get a buyer.

Price to sell

Using insights from your real estate agent, market trends, and your own research, decide on a list price that will be appealing enough to potential buyers to help you sell quickly.

Potential downsides

- Your home could sell slowly: It could take longer than you expect for your house to sell, which could limit your ability to move forward with purchasing a home in your new location. If this happens, you can talk to your bank about either a bridge loan or a home equity line of credit, which help you access the equity you have in the house you’re selling to make a down payment on a new purchase.

- Your home could sell faster than expected: Of course, you want your home to sell, but if it sells immediately, you may be left without a place to live. If this happens, you can negotiate with the buyer to see if they’d be willing to do a rent-back, where you proceed with the closing but then rent the home back from the new owner for a few months while you make your final moving preparations.

Option 2: Buy a second home before selling

If you can swing it financially, buying a home in your new city before you sell your old home can be the easiest, least stressful option. Since you’ll likely be searching from afar (and cramming in lots of showings whenever you are able to set foot in your new city for a weekend), you’ll want a real estate agent with relocation experience. Find someone you can trust by asking for referrals from friends and colleagues living in the area.

Here are the key benefits of buying first:

You’ll only have to move once

Once you’re ready to make the leap, you’ll have a new home waiting for you — no temporary housing required.

You can start your new job quickly

If you line up a new place to live first, you can dive right into your new job, instead of worrying about house hunting.

Potential downsides

- Carrying two mortgages: It’s expensive to pay two mortgages every month, so you’ll want to sell as quickly as possible.

- Slow sale of your current home: Depending on the state of the housing market you’re leaving behind, it may take longer than you expect to sell your house.

- Limited buying power: If your equity is tied up in your yet-unsold home, you may have to lower your budget, since you won’t have the equity available to put toward your down payment.

Option 3: Rent it out

Another one of the options for selling your house is ... not to sell! In certain cases, it can be advantageous to keep the home and rent it out.

Strong rental market profits

If you’re in a strong rental market, you may be able to charge more in rent than your mortgage costs you every month, giving you an additional income source.

Tax benefits for improvements

Rental property owners enjoy tax benefits for home improvements they make. Ask your tax professional for more information.

You can move immediately

Instead of waiting for your home to sell, you’ll only have to find tenants, fast-tracking your move to your new location.

Potential downsides

- Property management costs: Monthly property management fees can quickly cut into your rental profits, and it’s challenging to try and manage it on your own from afar.

- Carrying costs: Remember, you’ll still be on the hook for costs like property taxes, HOA dues, and homeowner’s insurance.

- Upkeep and maintenance: You’ll have to manage repairs and maintenance from many miles away, which can be stressful and expensive.

Written by

Kristijonas Umbrasas

11.25.2019

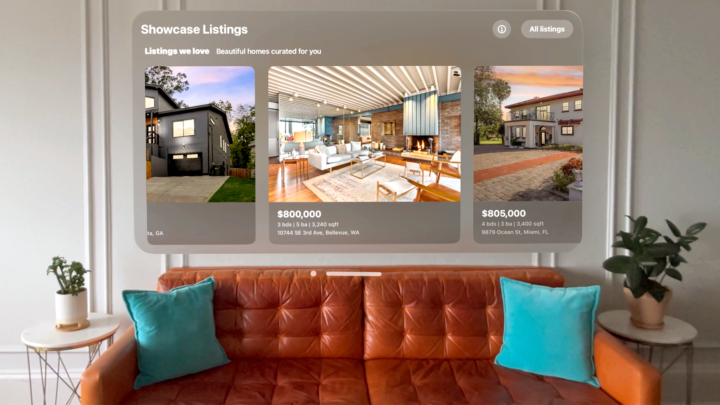

Ready for a new address?

Get an instant cash offer or list with a local partner agent.

Explore selling options