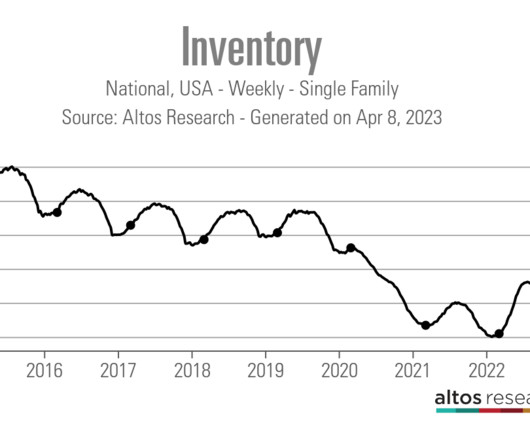

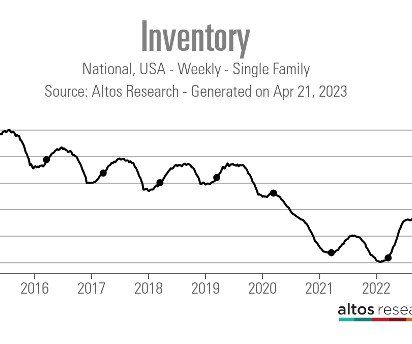

New listings data falls for third week in a row

Housing Wire

MAY 18, 2024

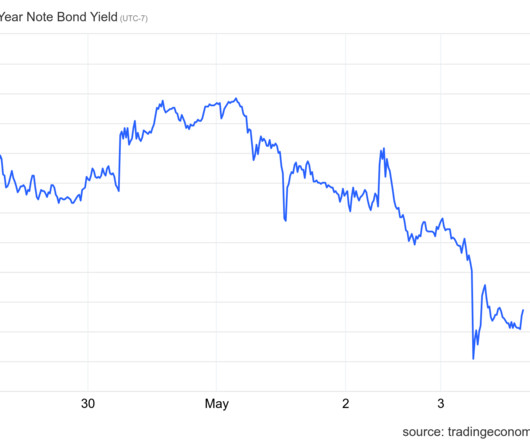

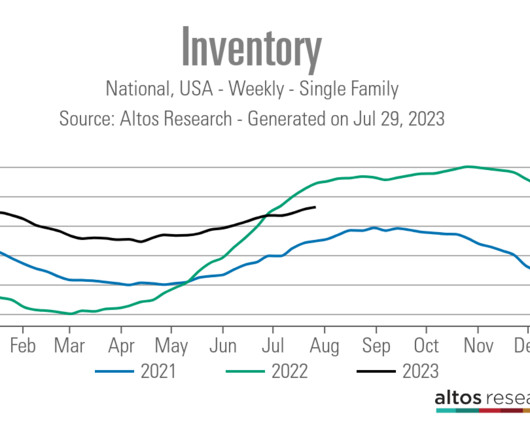

New listings data has been moving lower over the last few weeks. But, we need to see more growth in new listings data just to grow from 2023 levels. 2023 new listings data was the lowest ever on record, so it’s already a low bar. We need to crack this uptrend to see mortgage rates move lower and stay lower.

Let's personalize your content