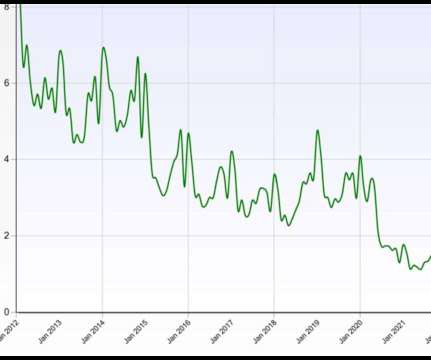

Low-income owners’ home values have increased by 75% since 2012

Housing Wire

APRIL 18, 2023

Between 2012 and 2022, the nationwide median value of homes owned by low-income households (households earning no more than 80% of metro area’s median income) rose 75%, or $98,910. Middle-income homeowners in Ogden recorded the largest wealth gain among all metros for their income bracket, gaining $220,000 in wealth from 2012 to 2022.

Let's personalize your content