Mortgage demand picks up as seller concessions rise

Housing Wire

JANUARY 11, 2023

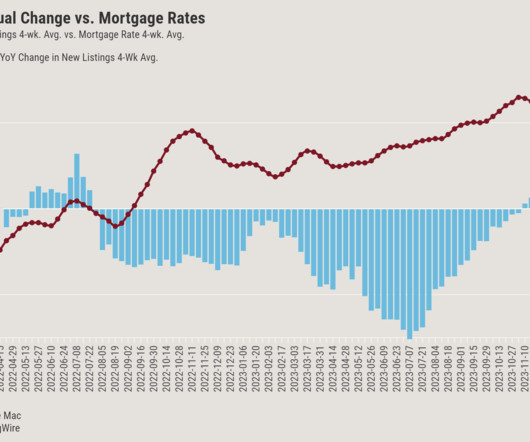

Loan officers saw an increase in mortgage demand during the first week of 2023 as mortgage rates ticked down. And to close deals, sellers are increasingly coming to the table with concessions and rate buydowns. . ” Gano’s experiences reflect what happened in the market overall.

Let's personalize your content