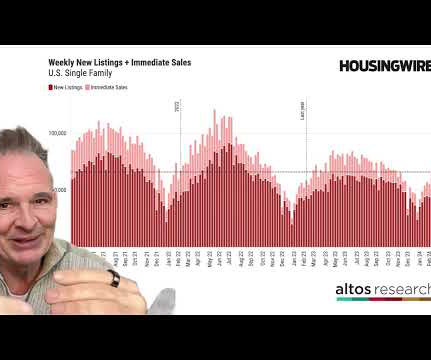

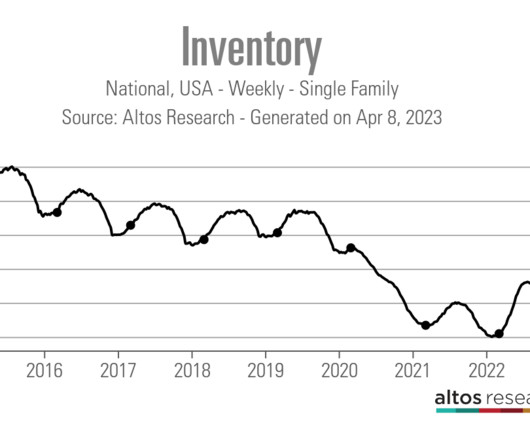

Home sellers are returning to the market

Housing Wire

APRIL 29, 2024

It’s still April, so there could be as many as eight more weeks of seller growth in the spring housing market. And seller growth is happening pretty much everywhere across the country, with Florida and Texas leading the way. The bearish take is that there are many more sellers than buyers and inventory is rising.

Let's personalize your content