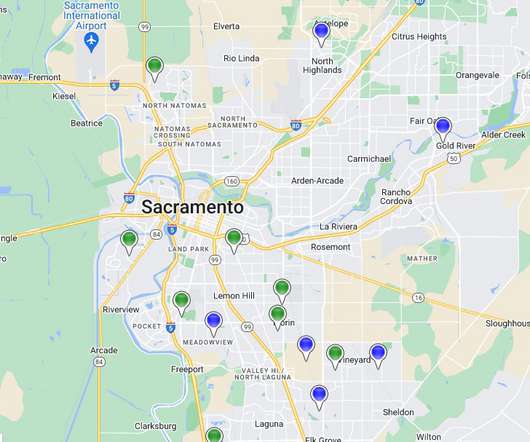

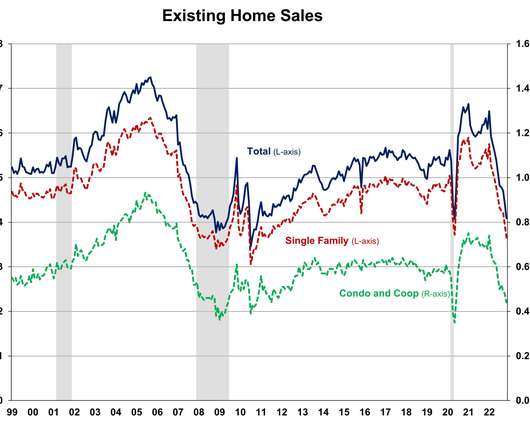

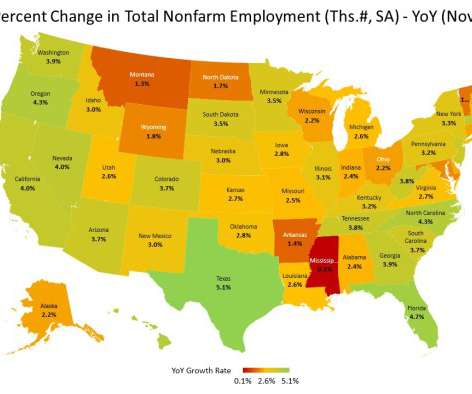

Are foreclosures and short sales coming back to the housing market?

Sacramento Appraisal Blog

DECEMBER 19, 2022

A foreclosure wave is coming!!! And short sales are about to be unleashed!!! That’s often the housing narrative, and let’s talk about that while looking at some changes we’re starting to see in the Sacramento market. I hope this is helpful, whether you’re local or not. Skim by topic or digest slowly. UPCOMING (PUBLIC) SPEAKING […].

Let's personalize your content