How auction buyer data foreshadows housing market shifts

Housing Wire

JULY 21, 2022

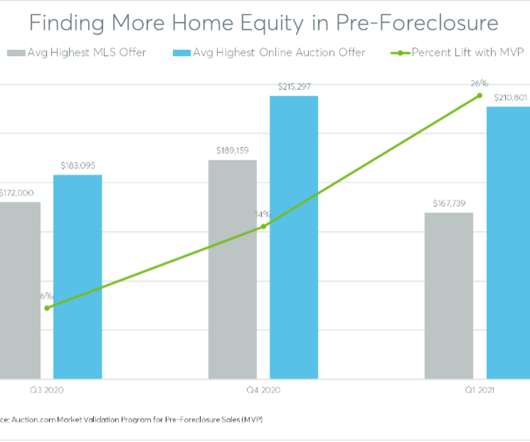

Retail housing market data from June showing early signs of a real estate slowdown was foreshadowed three months earlier in buyer behavior at foreclosure auctions. The as-is market value is typically based on a drive-by broker price opinion or external-only appraisal given the properties are usually still occupied.

Let's personalize your content