Growth of Household Real Estate Market Value Slows in Q2

Eyes on Housing

SEPTEMBER 22, 2022

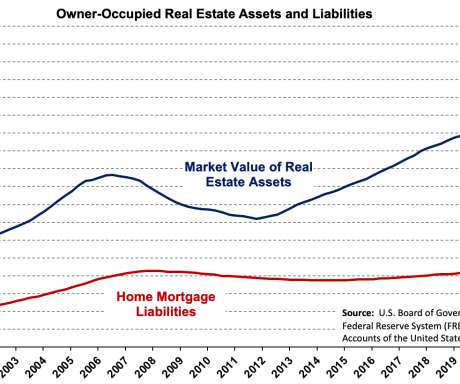

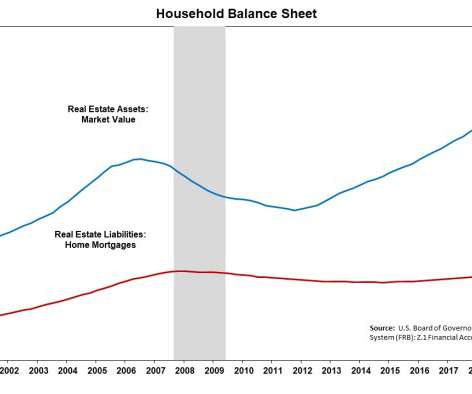

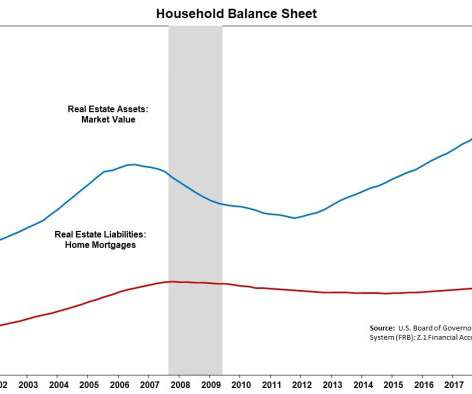

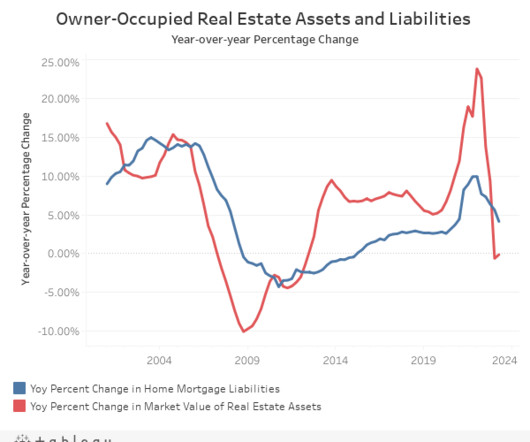

1 Financial Accounts of the United States, i.e., the Flow of Funds, show that in the second quarter of 2022, growth of the market value of all owner-occupied real estate in the United States slowed after showed the largest year-over-year percentage gain since 2001 the prior quarter. The market value of owner-occupied real.

Let's personalize your content