How will mortgage rates impact seasonal inventory in 2024?

Housing Wire

FEBRUARY 4, 2024

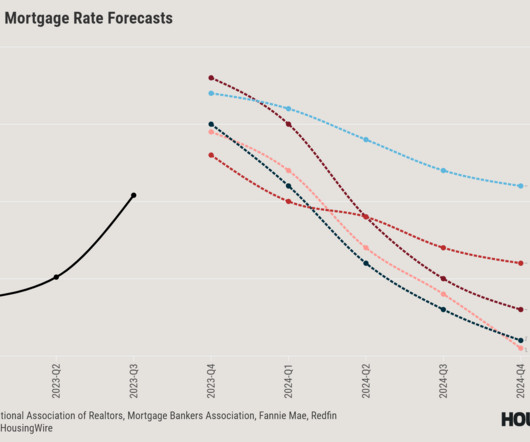

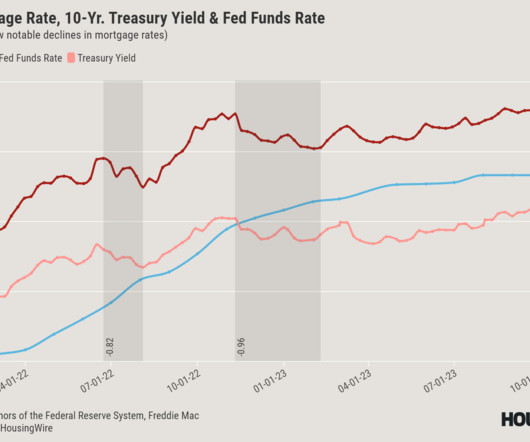

How will mortgage rates impact seasonal inventory in 2024? It’s not what I wanted to see in 2024, but I have to be realistic since we are already in February. Also, when mortgage rates rise, the inventory peak happens later in the year. Is the seasonal bottom going to happen later than I want?

Let's personalize your content