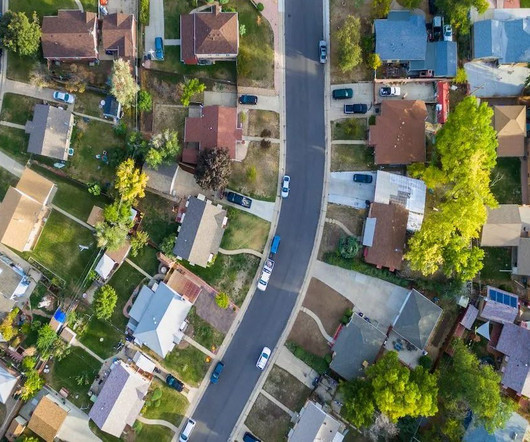

Spring housing market gets more inventory

Housing Wire

APRIL 27, 2024

Active weekly housing inventory growth slowed slightly last week, but it’s still running at a healthier clip than in 2023. I have a simple model with mortgage rates being above 7.25%: weekly inventory data should grow between 11,000-17,000 per week. We have now seen it for two weeks as inventory grew by 13,247.

Let's personalize your content