Developing a lending strategy for rising mortgage rates

Housing Wire

APRIL 8, 2021

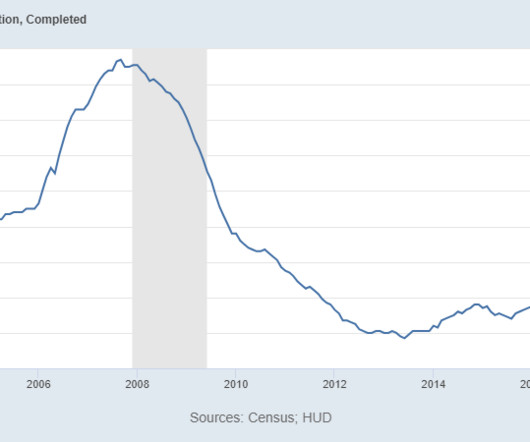

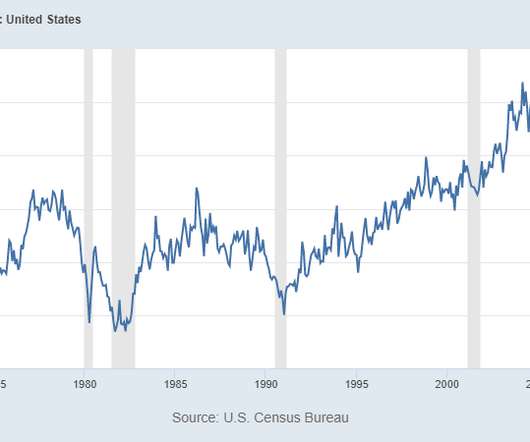

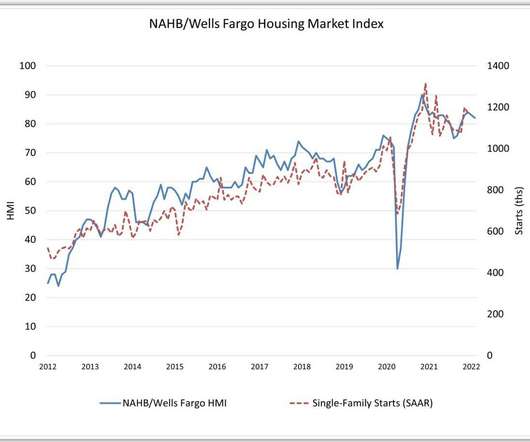

In fact, the largest home purchase year in this nation’s history was 2005 when rates were near 7.5%. The post Developing a lending strategy for rising mortgage rates appeared first on HousingWire. Mortgage rates have never been this low and yet through previous cycles home sales have continued.

Let's personalize your content