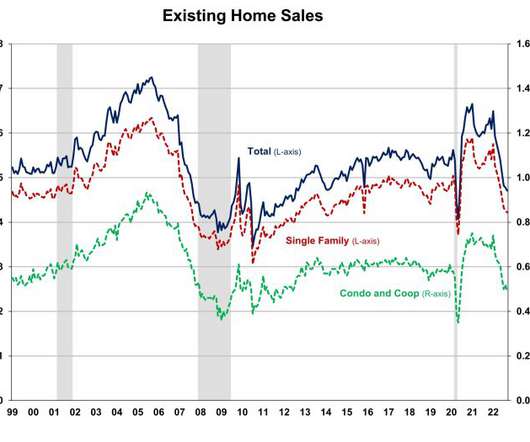

Is the savagely unhealthy housing market back?

Housing Wire

MAY 18, 2023

Just when I thought days on market were returning to normal, that number for existing homes fell back down to 22 days. If the days on the market are at a teenager level or even lower, it’s never a good sign for the housing market. This is why the days on the market are so low historically after 2020.

Let's personalize your content