Low housing inventory a win for homebuilders

Housing Wire

MARCH 23, 2023

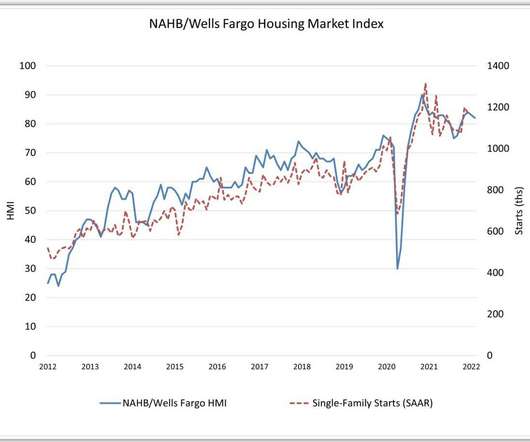

If there’s one sector of the economy that benefits from the very low levels of total housing inventory , it’s the homebuilders , but for a reason you might not think. If national housing inventory were back to normal, we would have 2 to 2.5 The builders will pull back on construction when the supply is 6.5

Let's personalize your content