Texas Real Estate Trends: Q3 2023 Comprehensive Review

It’s been a wild ride for Texas real estate this year! Interest rates have gone up, making many people unsure about buying or selling homes. Some areas like Austin and Dallas have seen big changes, while others like Houston and San Antonio are more stable.

If you’re thinking of buying or selling, or just curious about what’s going on, our guide breaks it all down. Read on to see what’s happening, why it matters, and what it could mean for you. Let’s make sense of it all together!

Navigating Texas Real Estate with Rising Interest Rates

We’re heading into Q4 of a tough year for the real estate market. From late summer of 2022 to now, the Texas real estate market has experienced one of the most unpredictable corrections in recent history, leaving a lot of home-buyers and sellers scratching their heads and trying to make sense of what is going on.

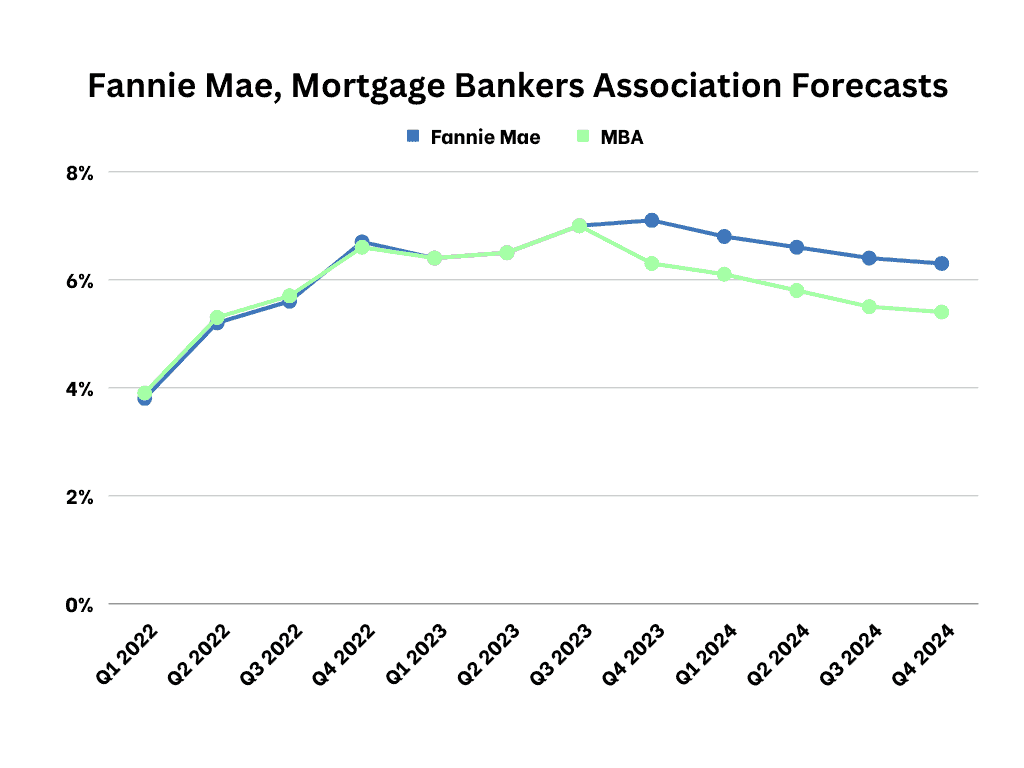

The big twist? A sharp increase in interest rates. Just 18 months ago, rates were nice and low, around 3%. But by mid-2022, they shot up to over 6%. Fast forward to now and they’re hovering around 7.3% (a slight drop from their 7.5% peak last month).

And the million-dollar question: How did Texas homes fare with these climbing rates? While many thought it’d spell bad news, the total meltdown hasn’t happened. At least, not yet.

The 5 most notable changes to the Texas Housing Market

To really understand how these rising rates have changed things, we need to look at the big shifts in the housing market. Here are five of the biggest changes in the Texas Real Estate market.

A Dip in New Mortgages

With interest rates soaring to unexpected heights, many prospective homebuyers have taken a step back from applying for new mortgages. Many have been caught off guard by the spike in rates and are cautiously waiting and hoping for home values to become more affordable. However, if we see a soft landing with a recession that day may not come.

Fewer New Listings

The number of new listings hitting the markets has continued to fall, mainly because a substantial segment of the market that was both buying and selling has essentially disappeared.

Most homeowners looking to sell their properties are doing so out of necessity rather than desire. Financially secure homeowners are firmly anchored to their homes with interest rates at 3% or 4%, and they are unwilling to trade that security in an uncertain market for rates north of 7%.

Increasing Days on Market and Months Supply of Inventory

Days on market and the months’ supply of inventory have witnessed a steady climb, indicating that homes on the market are taking longer to sell. This adjustment has been challenging for sellers to adapt to, as many had grown accustomed to the fast-moving market of the previous years.

Markets like Austin, which experienced the most substantial surge in values between 2020 and 2021, have seen the most significant increases in months’ supply of inventory and days on market.

The Rise of New Construction Homes

New construction is stepping up to fill the void in the market. In cities like Houston and Dallas, new construction now accounts for a substantial 28% of the market, meaning more than one out of every four homes sold is newly constructed. In a more balanced market, this statistic typically hovers closer to 16%.

Flat Growth Among Major Texas Markets

With the exception of Austin (more details below), the other major markets in Texas have witnessed essentially flat growth year over year concerning median sales prices. This may come as a surprise to many who had anticipated more significant declines in home values.

Texas Mortgage Rates Going Forward

Looking at the information shared above, it’s clear that we’ve been through quite a ride in the housing market. Think of it like a rollercoaster that started in late 2022 and has continued into early 2023. Right now, we’re in a phase where we’re coming to grips with the fact that interest rates are going to remain high for the rest of this year. We’re hopeful they might drop to the mid-6% range by the third or fourth quarter of the following year, and potentially even lower after that.

The Federal Reserve has been quite firm in their stance. They believe they have the tools to handle a potential recession, but they can’t do much about stopping runaway inflation. That’s why they plan to keep interest rates high for a longer period than we’d like, all in an effort to control inflation.

In simpler terms, all of this means that the real estate market in Texas, much like the broader financial world, has seen some significant changes. Understanding these changes can be really important if you’re thinking about buying or selling a house in Texas. So, let’s keep exploring what’s happening and why it matters as we move forward together.

Is It Still a Good Time To Buy or Sell a Home in Texas?

In my view, and that of many others in the real estate industry who closely monitor data, now remains a favorable time to be active in the real estate market. There’s a widespread industry belief that interest rates will gradually decrease over time. The key, however, is for buyers not to overextend themselves financially when making a purchase.

Instead of fixating solely on interest rates, it’s wise to focus on the opportunity to uncover outstanding home deals. Seize the moment to leverage the increased inventory and negotiate favorable prices. Should interest rates drop in the future, there’s always the option to improve your monthly expenses through refinancing.

Reflecting on the recent past, we endured a prolonged period of challenges for homebuyers and prosperity for home sellers. Between 2020 and 2022, it seemed like every transaction involved multiple offers, with sellers firmly in control. Now that the market has softened, buyers seeking long-term residences should be eager to negotiate favorable deals for themselves.

It’s easy to get caught up in the current moment, but for most homeowners, real estate is a long-term investment. Even if property values experience a slight dip in the short term, real estate has consistently proven to be one of the safest investments. Predicting market peaks and troughs is seldom possible. What we can do, however, is make informed decisions based on the available information.

So, remember, whether you’re buying or selling, real estate often plays out as a long game. Consider the potential for solid investments in the market, and make choices that align with your long-term goals

Interest Rate and Home Sale Predictions

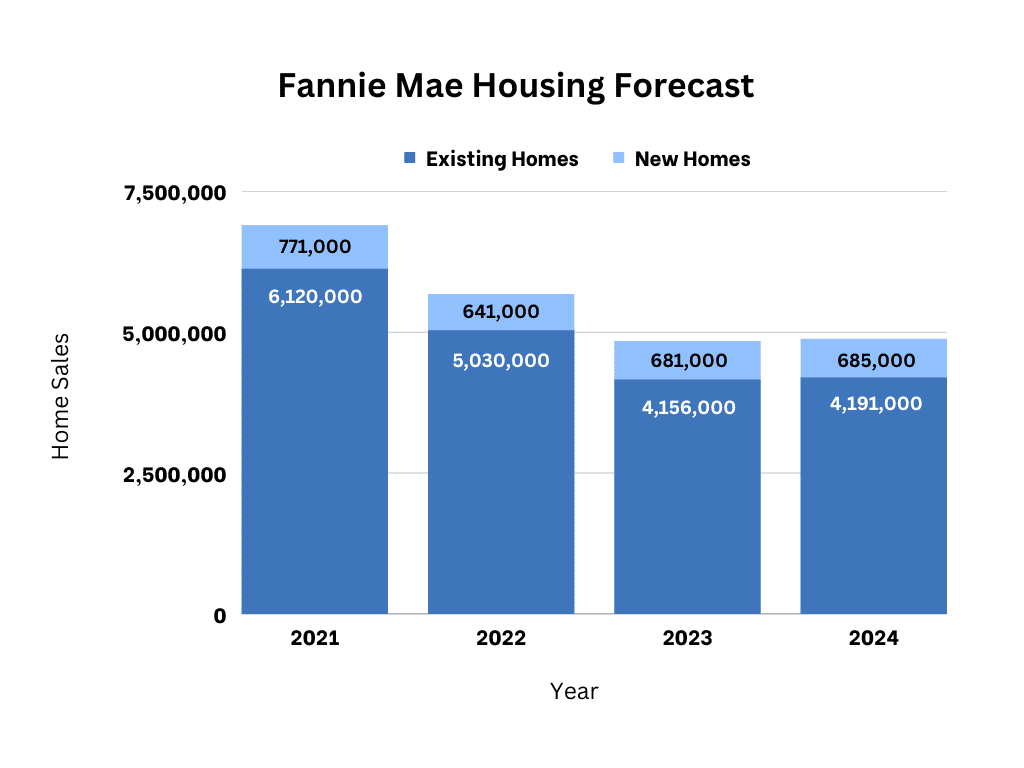

Taking a closer look at Fannie Mae’s insights into the housing market, their economists anticipate a significant 14.7% decline in home sales by the end of 2023, with a similar trend expected to persist in 2024.

Fannie Mae’s Chief Economist, Doug Duncan, explains, “We anticipate that overall housing market activity will continue to hover at a subdued level well into 2024. This projection is driven by the Federal Reserve’s commitment to maintaining interest rates in the face of inflationary pressures.”

Here’s a glance at Fannie Mae’s economists’ predictions for interest rates in the upcoming year:

Real Estate Market Trends in the Four Major Markets of Texas

In this section, we’ll dissect the key metrics and statistics for Texas’ top four major metropolitan areas for the month of August 2023.

Austin

- Median Sales Price: $460,000 (decrease of 7% YOY)

- Closed Sales: 2,939 (increase of 1% YOY)

- Average Days on Market: 60 Days (increase of 28 Days YOY)

- New Listings: 4,084 (increase of 1% YOY)

- Active Listings: 9,955 (increase of 12% YOY)

- Pending Sales: 2,686 (increase of 2% YOY)

- Months supply of inventory: 3.8 Months (increase of 1 month)

Key Takeaways

Austin is a bit of an outlier when it comes to the Texas real estate scene. Some reports suggest it has experienced the most significant drop in housing prices compared to any other major city in the country. But, here’s the catch: between 2020 and mid-2022, Austin had seen its home values skyrocket. So, it’s kind of expected that Austin would react differently during this correction.

Now, if you’re a home seller in Austin, patience is the name of the game. We’re looking at around 3.8 months’ worth of available homes on the market, which means it’s starting to feel like a buyer’s market. That’s a big shift from what Austin sellers have been used to for more than ten years, where it was definitely a seller’s market.

Dallas/Fort Worth

- Median Sales Price: $340,000 (decline of 1.1% YOY)

- Closed sales: $31,400 (decline of 7.2% YOY)

- Average Days on Market: 47 Days (increase of 11 days since August of 2022)

- Active Listings: 97,089 (increase of 16.4% YOY)

- Months Supply of Inventory: 3.5 Months (increase of 1 month YOY)

- Homes between $200,000 and $300,000 makes up 25.5% of the market share

Key Takeaways

When we look at the Metroplex area, it’s doing better than Austin, but it hasn’t escaped the changes in the market either. We’re seeing more days on the market and an increase in the months of inventory available, which tells us that the market is becoming more balanced.

Homes priced around or below the median are doing relatively well here. Affordability is the main challenge, but the good news is that you can still find affordable homes in and around Dallas.

Houston

- Median Sales Price: $339,000 (flat YOY)

- Closed Sales: 9,780 (decline of 4.3% YOY)

- Average Days on Market: 42 Days (increase of 10 days YOY)

- Active Listings: 38,439 (increase of 14.8% YOY)

- Pending Sales: 7,842 (increase of 2.2% YOY)

- Months Supply of Inventory: 3.3 months (increase of 0.9 months)

Key Takeaways

In Houston, single-family home sales have taken a hit, down by 3.8% when compared year over year. This decline marks the 17th consecutive month of decreasing sales volume. To put things into perspective, if we look back to August 2019 before the pandemic, sales have dropped by 8%.

However, even in the face of a slowing market, Houston shows signs of stability. Property values have remained relatively unchanged, and there’s a notable pent-up demand waiting in the wings. Many are anticipating a resurgence in the market once interest rates settle back into the low 6s or high 5s.

San Antonio

- Median Sales Price: $322,250 (decline of 1% YOY)

- Closed Sales: 3,168 (decline of 4% YOY)

- Average Days on Market: 56 (increase of 11 days YOY)

- New Listings: 4,566 (decline of 1% YOY)

- Active Listings: 11,467 (increase of 24% YOY)

- Pending Sales: 2,492 (decline of 21% YOY)

Key Takeaways

In San Antonio, the real estate scene mirrors that of Dallas and Houston to a great extent. Property values have experienced a slight dip but have largely remained steady. The number of new listings has also seen a minor decrease, primarily because sellers are taking a step back and waiting for more favorable market conditions. It’s a reasonable assumption that a significant portion of these sellers are also potential buyers themselves.

However, the most noteworthy statistic to keep an eye on is the 21% drop in pending listings. This plays a crucial role in the context of a 24% increase in active listings. Essentially, it implies that there are more homes on the market, but fewer of them are moving towards closing. For sellers in San Antonio, patience is becoming increasingly important.

The Impact of Commercial Real Estate on Residential Properties in Texas

When we consider the real estate landscape, the residential market in Texas has managed to hold its own quite well, considering the circumstances. However, my concerns lie more with the commercial real estate market. The big question remains: how will shifts in the commercial sector impact the residential scene?

Commercial Real Estate Uncertainty Amid Economic Challenges

Commercial real estate operates on a different set of dynamics compared to residential. It heavily relies on smaller local banks and loan products that differ significantly from the long-term, conforming residential loans that offer predictability and stability.

Many commercial real estate owners have counted on rental income and increasing property values to refinance their debt. However, with rent growth slowing down, higher vacancy rates, decreasing property values, and dwindling loan options, the commercial sector is facing some worrying signs.

While default rates are still relatively low, forecasts suggest a potential surge in distressed commercial properties.

Record Vacancy Rates and What They Mean for the Residential Real Estate Market

Notably, data from the National Association of Realtors (NAR) has revealed that office vacancy rates have hit a new record high, standing at 13.1%.

This is a significant development because corrections in the commercial real estate market can often foreshadow trends in the residential sector. Typically, higher vacancy rates signal a sluggish job market or layoffs, which can, in turn, lead to an uptick in distressed property sales.

However, this time around, the situation is somewhat different due to the emergence of companies adopting work-from-home options for their employees, potentially decoupling the traditional relationship between commercial and residential real estate.

Maximizing Your Home Sale in a Changing Real Estate Market

Lately, we’ve noticed an emerging trend with some sellers who purchased their homes in 2021 finding themselves in a challenging position. They’ve had to sell their home at a slight loss because the appreciation in their property’s value didn’t surpass their closing costs.

Thankfully, ListingSpark has been instrumental in minimizing these losses by saving them a substantial amount in commissions. As profit margins tighten, it becomes increasingly vital to have a clear understanding of the financial aspects of selling a home. You can take advantage of our closing cost calculator to gain a comprehensive understanding of your expenses as a seller.

Tailoring Your Home Selling Strategy to Local Real Estate Realities

It’s crucial to remember that real estate is inherently hyper-local, and this fundamental aspect hasn’t changed. The statistics we’ve shared encompass a broad metropolitan area and may not precisely mirror the conditions in your specific localized market.

Given this, here’s some valuable advice for sellers navigating the current landscape:

- When setting the price for your home, consider aligning it competitively or adopting an assertive stance within this market.

- With buyers having more options now, there’s a decreased sense of urgency, and they’re eager to secure a favorable deal. Be prepared to engage in negotiations and maintain emotional detachment throughout the process.

- When you’re analyzing market data, pay closer attention to active listings and pending sales than you might have in the past. These metrics provide the most up-to-date insights into market conditions. If you notice a significant number of properties similar to yours on the market but relatively few pending sales, you may experience a longer-than-average time on the market.

- Staying informed about price adjustments and properties going under contract within your market is essential. Approach other listings with an objective mindset, putting yourself in the shoes of a potential buyer rather than solely adopting the perspective of a seller.

Empower yourself with these insights and approach the market with a strategic mindset. In today’s hyper-local real estate landscape, knowledge and adaptability are your greatest assets.

The Bottom Line

In conclusion, the Texas real estate landscape has been a rollercoaster ride in 2023, and it’s essential to understand the dynamics at play as we head into the final quarter of the year. Rising interest rates have challenged the market, but Texas homes have shown resilience despite the odds.

We’ve highlighted five significant changes in the Texas housing market, including a dip in new mortgages, fewer new listings, increased days on market, the rise of new construction homes, and generally flat growth among major Texas markets, with the exception of Austin.

Speaking of Austin, it has experienced a unique correction due to its meteoric rise in home values before the downturn. Patience is crucial for sellers in Austin as it transitions into a more balanced market.

The Dallas/Fort Worth Metroplex has seen a shift towards a more balanced market, with homes around or below the median price performing better.

Houston has faced declining single-family home sales, but there is optimism for a resurgence once interest rates stabilize.

San Antonio’s real estate scene mirrors Dallas and Houston, with slightly declining property values and sellers exercising patience.

The commercial real estate sector poses uncertainties, and shifts there could impact the residential market, but the transition to remote work is a unique variable.

As always, ListingSpark is here to assist you with any real estate questions or needs. We serve over 13 different MLS markets in Texas and look forward to helping you with your next sale. Reach out if you have any questions about real estate, and let’s navigate this evolving market together.

Related Posts

How to Unlock Potential with Real Estate Software for Investors

In the fiercely competitive world of real estate investment, picking the right tools can be the difference between profit and losing money on a property. As digital innovation continues to reshape the landscape, a new…

Modern House Flipping Software: 8 Innovative Tools You Need

House flipping isn’t just an opportunity for big real estate companies or home improvement television channels—it’s becoming a reliable source of income for Americans running a solo business or small real estate investment venture. While…

Smart Savings: The Advantages of Flat-Fee Listing on the MLS

Selling a house traditionally has always been an arduous process, and right now, it’s even more turbulent. With the current NAR settlement shaking up commission processes and costs for buyers and sellers, investors have even…