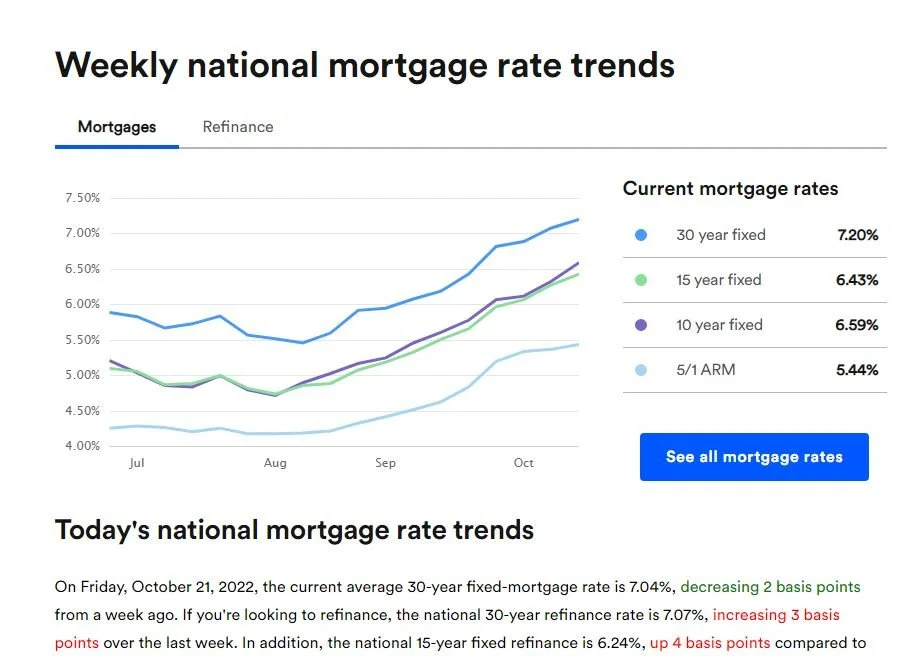

You would have to be living under a rock to not know that interest rates have been steadily rising and are currently at levels we have not see in many years.

According to the latest article as of this writing dated 10/21/2022, the 30 year fixed rate mortgage remains just shy of 7%. This is having a direct impact that is negatively impacting the housing market.

https://www.cnn.com/2022/10/20/homes/mortgage-rates-october-20

Image taken from bankrate.com

In the past month, I have started to see increasing supply that will soon be balanced and in my opinion, if the current environment remains the same or rates continue to rise, we will see the balance at best or the oversupply at worst we are used to seeing.

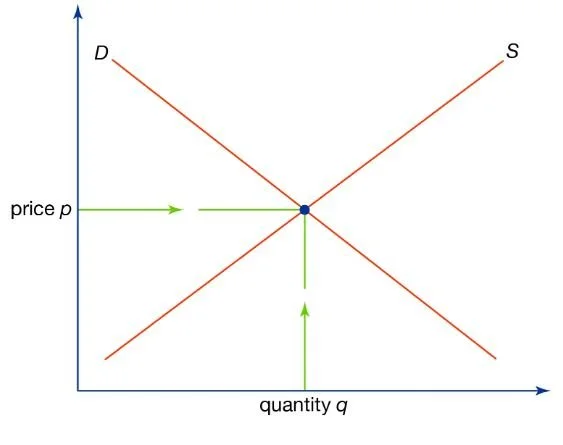

What happens when you have decreasing demand and higher supply?

This negatively impacts sales prices. In turn, this causes values to decline.

Unfortunately, this is not good news. It is difficult to know how far this decline will go or how long it will last. According to the CNN article I referred to, home sales have been falling month over month and we are in the longest housing sales slump since October 2007. They also state that applications for home purchases are down 38% and those for refinances have fallen off of a cliff.

This might not be the case for home appraisals and the home sales in our market area, but as is historically accurate in the past, we tend to be on the back end of the national curve. If what they say is true, then we are in the very beginning of this same slump and need to be prepared for the ride.

If you are in the market to purchase a home, refinance or require a home valuation for other purposes such as estates and divorces, you need to be prepared for the value of the property to possibly show a decline from the past 2 years.