One of the first things you learn when you’re in the market for a new home is that no house is perfect. There will be things you like and dislike about every home you see. That doesn’t mean you need to live with the things you don’t like once you buy a house, though. After your purchase, you can renovate the property to make it suit your tastes and fit your needs.

Depending on the extent and cost of your home improvement goals, you might need to take out a loan for renovations. A home renovation loan is most likely not going to be the same as your mortgage. Learn more about loan options for remodeling your home to see which one will work for you.

Why Remodel Your Home?

Whether you buy a home with an eye for renovating it or want to fix up a home you’re already in, there are several reasons why remodeling can make sense. Some reasons to renovate your home include:

- Update the design: Although some designs have more staying power than others, a home can start to look dated if its finishes and fixtures aren’t refreshed from time to time. Remodeling your home can give it a new lease on life and make it look more modern. Plus, a renovation allows you to update your home’s technology so you can bring in features, such as USB outlets and smart appliances.

- Make your home bigger: Your household size might have changed since you first bought the house. Maybe you got married or added to your family. You might feel like your home is bursting at the seams. You can add to the house with a renovation, giving you more bathrooms or bedrooms, as needed.

- Make your home suit your lifestyle: Similarly, your lifestyle and habits might have changed since you bought your home. You might want to turn a bedroom into a home office or finish your basement so the kids can use it as a play area. Maybe your in-laws are moving in, and you want to create a separate suite for them.

- Improve your home’s energy efficiency: Older homes can be much less energy efficient than newer ones, increasing utility bills. Renovating an older home allows you to seal it and stop drafts and other leaks.

- Get on top of maintenance: When you renovate your home, you can replace and update fixtures before needing significant repairs. For example, it’s usually better to replace your roof before it springs a leak and causes damage to the structure of your home.

- Get a good deal on a fixer-upper: If the homes you want to buy are all out of your price range, purchasing a house that needs a little care and attention can help you save money while getting the potential home of your dreams. Depending on the market, it might cost you less to buy and renovate a fixer-upper than to purchase a move-in-ready home.

Should You Take Out a Loan to Remodel Your House?

While you might prefer to pay upfront and in full for a home renovation project, doing so isn’t always possible. If the project’s estimated cost is high, you might need years to save up enough to cover it. In the meantime, you’ll be left living in a home that isn’t quite right. If you haven’t purchased your house yet, home prices might rise in the time it takes you to save for a renovation.

For that reason, taking out a loan to remodel your home can make the most sense for you. If you’re trying to decide if a fixer-upper loan will work for you, here are some things to consider:

- If you can afford the repayments: Whether you’re buying a fixer-upper or are renovating a home you’re living in already, you need to afford the monthly loan payments. Look at your income and current housing costs and calculate whether there’s any wiggle room in there to add on an additional monthly expense. You might also make cuts elsewhere in your budget to afford the renovation loan payments.

- If the renovations increase your property value: While you can’t expect to recoup the entire cost of a renovation if you end up selling your home later on, it can be worthwhile to see if your remodel will make your home more valuable, and if so, how much value it will add to your home.

- If renovating is better than moving: In some cases, it makes more sense to find and buy a new home or build a home from scratch than it does to remodel your existing property. Think about how extensive your renovations will need to be to make your home suit you before you decide to move forward with a renovation loan.

Can You Add Renovation Costs to Your Mortgage?

If you’re buying a home that needs some TLC, it can make sense to see if you can use some of your mortgage to pay for the cost of renovations. In some cases, you have the option of doing that. But you need to choose the right type of mortgage. Most conventional home loans can’t be used to cover the cost of renovations and the home’s purchase price.

To add the cost of remodeling to your home loan, you should look for a renovation mortgage. Then, when you apply for the mortgage, you borrow enough to cover the home’s purchase price plus the cost of the renovation.

When you close on the renovation mortgage, the lender will pay the seller the home’s sale price. The rest of the borrowed amount will go into an escrow account. For example, if your mortgage is $150,000 and the house costs $100,000, the seller will get $100,000, and the remaining $50,000 will go into an account.

The company performing the renovations will have access to the escrow account and will be able to pull payments from it as work continues on the project and milestones are reached. The lender will verify that work is completed before the contractor gets paid.

What Loan Is Best for Home Improvements?

The best way to finance home improvements depends on several factors, including your current homeownership status, the renovation project’s cost, and your credit score. Take a look at some of your loan options.

1. Construction Loan

While many people get a construction loan to cover the cost of building a home from the ground up, you can also get a construction loan to cover the costs of renovating an existing home. Although the application process is similar, a construction loan is slightly different from a mortgage. To get the loan, you need to provide proof of income and undergo a credit check. You’ll also need to make a down payment on the loan.

If you decide to get a construction loan to pay for home renovations, you might need to make a larger down payment than you would for a traditional mortgage. Usually, lenders expect borrowers to put at least 20% down when they finance renovations or new construction. Also, there interest rate on a construction loan might be higher than the interest charged for a conventional mortgage.

After the renovation is complete, a construction loan will typically convert to a mortgage. It can do that automatically, or you might have to go through the closing process again.

2. Fannie Mae HomeStyle Loan

The Fannie Mae HomeStyle loan is a conventional mortgage that also covers the costs of renovating a home. It’s not a construction loan. Instead, your lender will consider the cost of your renovation project when calculating the amount you can borrow. When you close the loan, the seller gets the purchase price, and the rest of the funds go into an account. To get access to those funds, the contractor you hire needs to submit plans for the remodeling project.

There are some benefits and drawbacks to using a Fannie Mae HomeStyle loan to pay for your renovations. One of the benefits of the loan program is that it allows you to buy and remodel a fixer-upper without making a large down payment.

A notable drawback of the HomeStyle loan program is that not every lender offers it. That can mean you need to hunt around to find the loan option. If you find a lender that offers it, you might not get the best loan terms.

3. USDA Home Repair Loan

The United States Department of Agriculture (USDA) offers a home loan program that helps people who want to purchase property in rural or suburban areas get a mortgage. The USDA also has a program designed to help borrowers pay for remodeling a home. Since USDA loans are intended for people who otherwise wouldn’t get a mortgage or loan, you need to meet specific requirements to qualify for the program.

First, the home needs to be in the right area. You can’t use a USDA loan to pay for renovations on a home in a city or urban environment.

Second, your household income needs to be less than 50 percent of the median income in your area. You also need to own and live in the home you’ll be renovating.

The maximum amount you can borrow through the USDA’s Home Repair loan program is $20,000 as of 2021. You can use the funds to repair or modernize the home or get rid of health and safety hazards.

4. FHA 203(k) Loan

The Federal Housing Administration (FHA) loan program helps people who might not have the best credit score or a big down payment to purchase a home. The FHA 203(k) program is similar but designed for people looking to buy a house to renovate.

With an FHA 203(k) loan, you can finance up to 110% of the appraised value of the property or the cost of the property plus the cost of the remodel, whichever is less. To get the loan, you need to work with an FHA-approved lender that offers 203(k) loans. Not all FHA lenders offer 203(k) loans.

Like typical FHA loans, the FHA 203(k) loan program provides funding to borrowers who might not qualify for conventional mortgages or construction loans. The credit score requirement is lower than for conventional loans, and you can put down as little as 3.5%. You will need to pay mortgage insurance for the life of the loan, which can be a drawback for some borrowers.

5. Refinance Loan

If you’ve been living in your home for a while, already have a mortgage and want to make some home improvements, refinancing your current home loan can be one way to pay for your renovations. When you refinance, you can tap into the equity in your home and use it to cover the cost of your project.

With a refinance, you trade one mortgage for another. The new mortgage might have a lower interest rate than your current one or it might be for a higher amount than your current home loan.

For example, when you first purchased your home, you took out a $200,000 mortgage and put down 20% on a $250,000 home. You had $50,000 in equity from the start. Now, you’d like to spend $50,000 on a home renovation project. You currently have $180,000 left on your mortgage.

To get the $50,000 you need for the home renovation, you refinance your existing mortgage to one worth $230,000. The $180,000 goes toward paying off the first loan and you get $50,000 in cash to pay for your renovation.

Refinancing might be a good option but it’s not always the best choice. When you refinance, you do have to pay closing costs all over again, which can add to the cost of your renovation project. Also, depending on when you refinance, you might end up paying a higher interest rate on your new mortgage.

6. Home Equity Loan

As you pay down your mortgage, you build equity in your home. The lower your mortgage is compared to the value of your home, the more equity you have. If you decide to sell your home, you get to pocket the equity from the sale and use it to buy a new home or reach other financial goals.

You can also use your home’s equity to finance renovations. One option is to refinance your loan, as described above. You can also borrow against your home’s equity, either by taking out a line of credit or getting a separate home equity loan.

Similar to your mortgage, a home equity line of credit or loan is backed by your home. If you have trouble repaying the loan or lien of credit, there is a risk of losing your property.

How much you can borrow against your home’s equity depends on the type of loan you get. With a home equity loan, you receive the payment in one lump sum. You then repay it over time, in equal monthly installments.

You can borrow as needed during the draw period with a home equity line of credit. If you repay the amount, you can borrow more. A home equity line of credit is similar to a credit card in that way. Once the draw period is over, though, you’ll need to start repaying it and won’t be able to borrow more.

7. Personal Loan

A personal loan is an unsecured loan that you can use for pretty much any purpose. Since there’s no collateral behind a personal loan, it will most likely have a higher interest rate than a mortgage or home equity loan. But you also have more freedom when it comes to using the loan money. The process of applying for and receiving a personal loan can also be more straightforward and cheaper than the process of getting a mortgage.

Whether you decide to get a personal loan or not depends on how much equity you have in your home and the size of your renovation project. If you’re just making a few small repairs or minor upgrades, it can make more sense to use a personal loan for your project. But if your renovations will be extensive, a construction loan, refinance or home equity loan might make more sense.

[download_section]

Can You Use a Credit Card to Pay for Home Renovations?

In some cases, it can make sense to use a credit card to pay for a home remodel. But before you do so, it’s important to know the drawbacks.

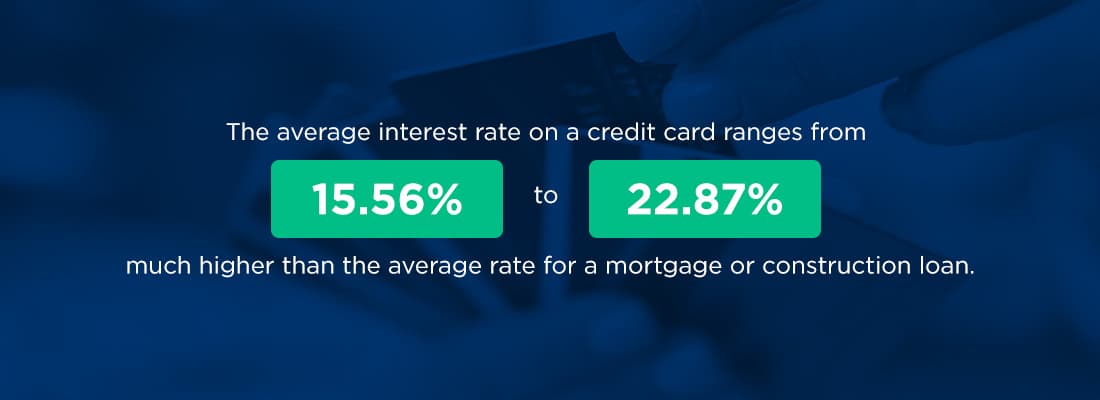

Perhaps the biggest disadvantage of using a credit card for a renovation project is the high-interest rate. The average interest rate on a credit card ranges from 15.56 to 22.87%, much higher than the average rate for a mortgage or construction loan. Credit cards also tend to have higher interest rates than personal loans. A higher interest rate means that you’ll end up paying much more in the long run if you use plastic to fund your remodel rather than a refinance or another type of home loan product.

There’s also your credit limit to consider. Many credit cards have credit limits that are much lower than what you can borrow with a construction loan or home equity loan. If your card has a $10,000 credit limit, you’ll either need to pay it off in full before using it again or use a different card to pay for the rest of your project.

There are some instances when using a credit card to pay for a remodeling project can make sense, though. If the project is small and you know you’ll pay it off quickly, a credit card can be the quickest and easier way to pay. Also, if you have a card that has a 0% interest introductory offer and you pay the project price in full before the introductory period ends, you can stand to save a considerable amount in interest.

Generally speaking, though, credit cards are best used for everyday or emergency purchases and shouldn’t be used to finance major projects such as a home renovation.

Apply for a Home Renovation Loan With Assurance Financial Today

If you want to remodel your home, you have options when it comes to paying for it. Assurance Financial can help you make sense of your home renovation loan options and choose the one that’s best for you. We offer construction loans and refinancing as well as USDA loans to qualified borrowers. Get started on your application today.

Linked Sources:

- https://assurancemortgage.com/construction-loans/

- https://assurancemortgage.com/how-to-finance-new-construction/

- https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-repair-loans-grants

- https://assurancemortgage.com/everything-need-know-fha-loans/

- https://www.hud.gov/program_offices/housing/sfh/203k/203k–df

- https://assurancemortgage.com/guide-to-cash-out-refinancing/

- https://assurancemortgage.com/is-refinancing-a-bad-idea/

- https://assurancemortgage.com/building-home-equity/

- https://money.usnews.com/credit-cards/articles/average-apr

- https://assurancemortgage.com/apply/