Commentary: What an industry pro learned after helping his parents get a reverse mortgage

Housing Wire

MARCH 11, 2024

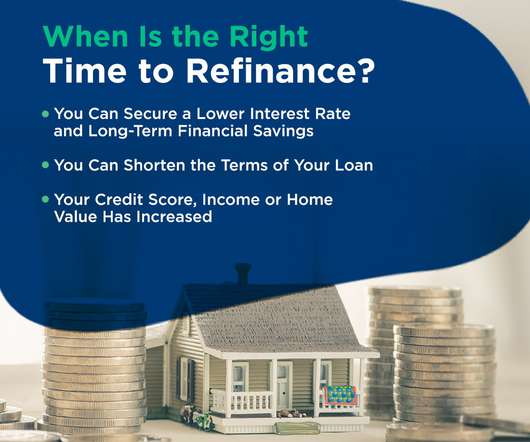

Working in this space for so long, I thought I knew the ins and outs of a reverse mortgage, but it wasn’t until I experienced one firsthand that some things really hit home for me. This created a win-win for my parents and is a common reason older homeowners use a reverse mortgage: to leverage their home equity.

Let's personalize your content