3 unique mortgage products to get today’s homebuyer qualified

Housing Wire

FEBRUARY 28, 2024

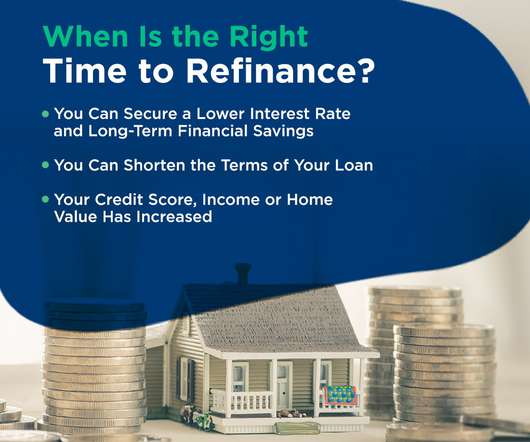

HousingWire: What factors are contributing to borrowers falling out of the Agency market? Tom Davis: The main issue with fall-out scenarios is that the government-sponsored enterprises ( GSEs ) have a tighter box with underwriting standards. HW: Why are DSCR cash flow, bank statement and second lien mortgages popular right now?

Let's personalize your content