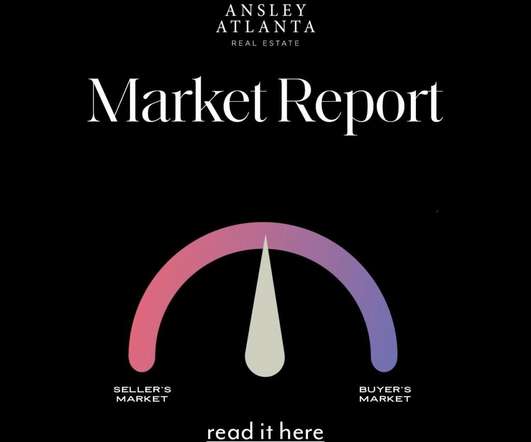

Mortgage market affordability and inventory challenges

Housing Wire

JULY 7, 2022

With a rapid spike in interest rates, inventory at historic lows, home prices rising at unprecedented levels above income, and a purchase market that is both highly anxious and digitally reliant, mortgage and real estate professionals must be strategic to capture the market opportunity today. Inventory rising, historically low.

Let's personalize your content