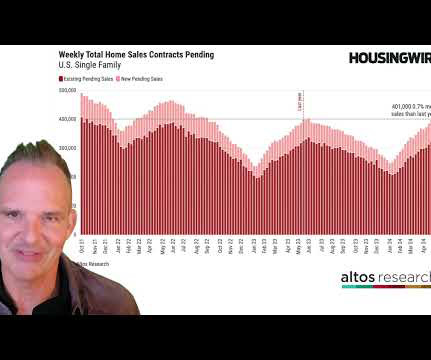

The insurance crisis is affecting the housing market

Sacramento Appraisal Blog

APRIL 24, 2024

Insurance has been a glaring mess in California, and it’s really starting to affect the housing market. Today, I want to share some things I’m hearing from the real estate community after asking for feedback on my social channels about home and fire insurance.

Let's personalize your content