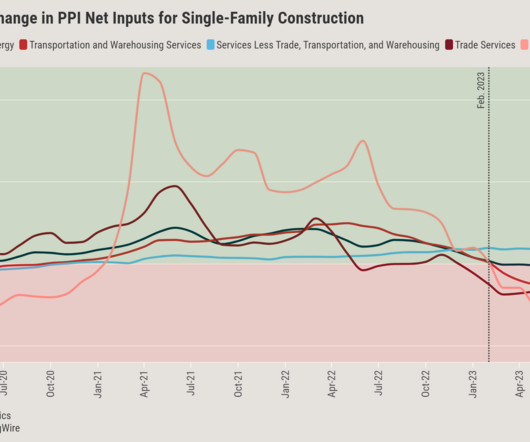

Supply chain issues still stymieing homebuilders

Housing Wire

FEBRUARY 18, 2021

Homebuilder confidence in single-family homes jumped one point to 84 in February from 83 in January , according to the National Association of Home Builders and Wells Fargo Housing Market Index. Strong buyer demand in February helped offset supply chain challenges and a surge in lumber prices, according to Chuck Fowke, NAHB chairman.

Let's personalize your content