New listings surge as the spring buying season approaches

Housing Wire

MARCH 15, 2024

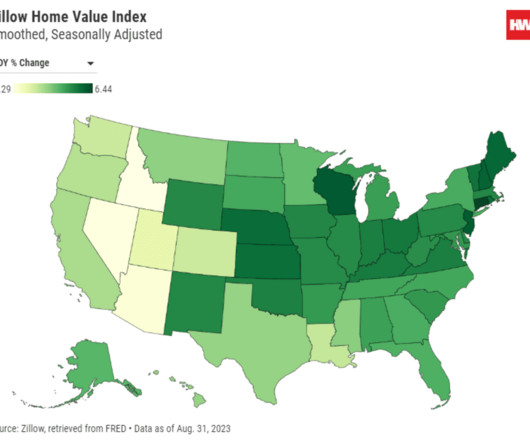

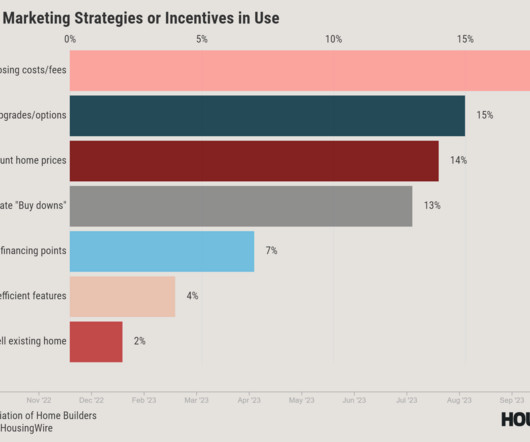

Prospective homebuyers have more options to choose from in the housing market, which could help spur sales this spring. Mortgage demand has been on the rise for two weeks in a row. Despite an influx of new listings, the market remains competitive for attractive, well-priced properties. The typical home in the U.S.

Let's personalize your content