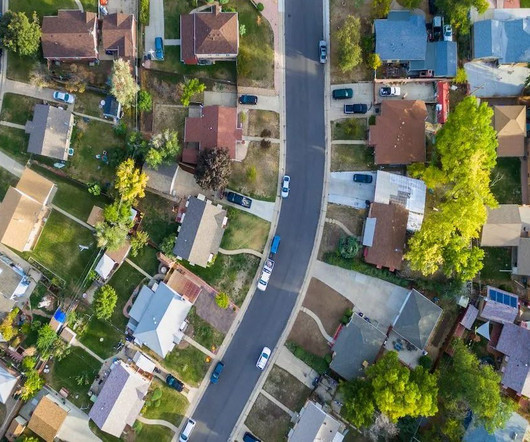

The mortgage rate lock-in didn’t start in 2022

Housing Wire

MAY 15, 2024

After an initial rush to get to market in Q2 2022, new listings volume fell precipitously. In July 2022, new listings volume per week dropped from 90,000 at the end of June to approximately 74,000 just after the July 4th holiday. That’s a swing of 17% fewer sellers in just a matter of days.

Let's personalize your content