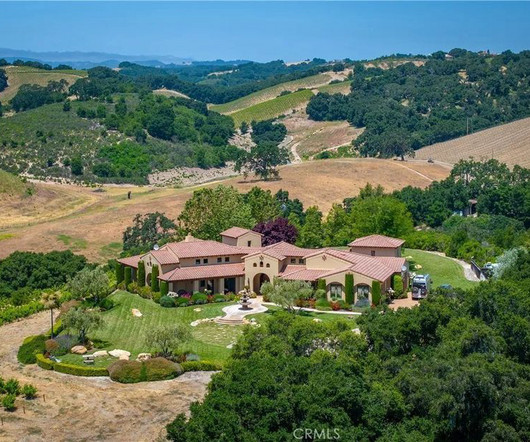

Finaya Unifies Home Buying and Selling, Mortgage, Insurance, Title and Closing Services

Appraisal Buzz

MAY 22, 2024

Technology firm Finaya has launched an AI-based homeownership marketplace super-app that integrates home buying and selling, mortgage, insurance, title, closing and other related services supported by a marketplace of on-demand realtors, loan brokers, lenders and service providers.

Let's personalize your content