What’s in a Sales Contract? Insights from a Seasoned Appraiser

McKissock

AUGUST 13, 2021

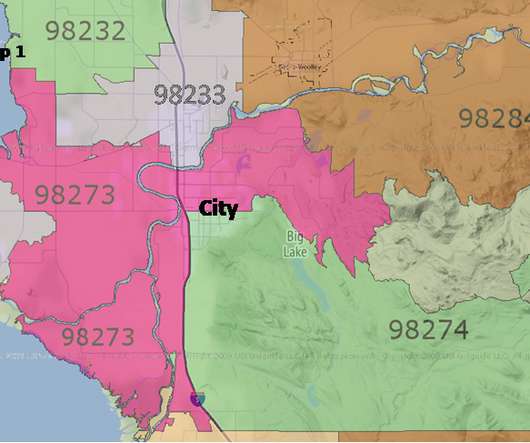

Why must an appraiser be given a copy of the sales contract? Secondly, the appraiser is likely familiar with the local real estate contract forms, customary terms, and conditions of real estate transactions in the area, and might be able to identify irregularities and comment on them. When should we analyze the contract?

Let's personalize your content