Mortgage applications fall amid low inventory, rising rates

Housing Wire

APRIL 6, 2022

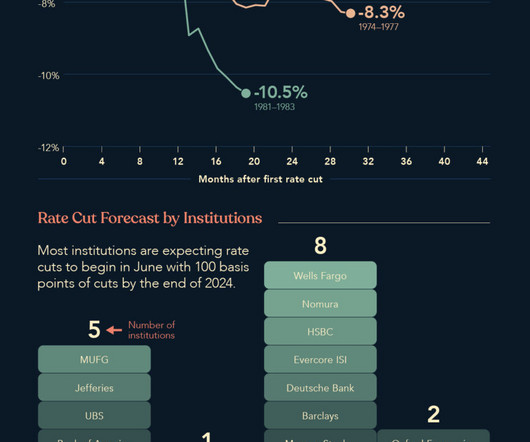

Interest in residential mortgage loans fell 6.25% for the week ending April 1 as rates jumped yet again , ever nearer to 5%, according to the Mortgage Bankers Association ‘s latest survey. Additionally, home price appreciation and insufficient for-sale inventory are holding back purchase activity. .

Let's personalize your content