Logan Mohtashami’s 2024 housing market and rate forecast

Housing Wire

JANUARY 1, 2024

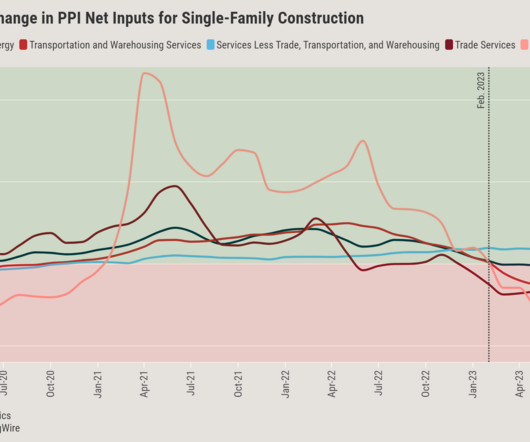

The 2023 housing market faced one of the same roadblocks we saw in 2022: mortgage rates were too high for home sales growth. Now that we’re in 2024, the Federal Reserve ‘s rate hike cycle is over, so let’s look at what that means for housing demand and home prices. Instead, they closed 2023 at 6.67%.

Let's personalize your content