Housing construction picked up in September, but developers are getting anxious

Housing Wire

OCTOBER 18, 2023

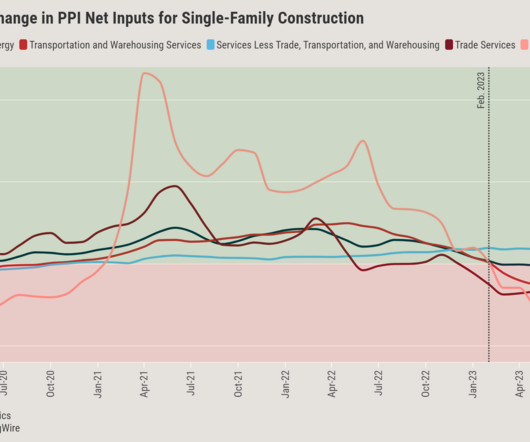

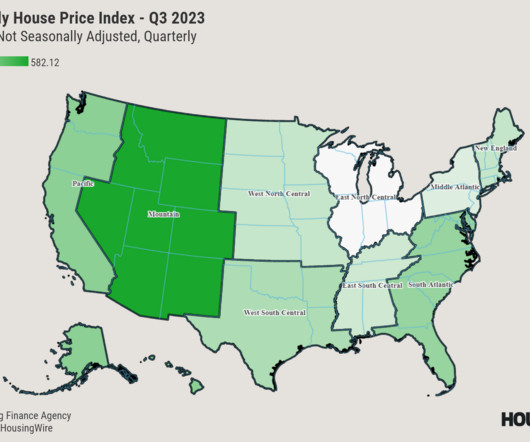

Housing starts climbed to a seasonally adjusted annual rate of 1,358,000 in September, according to U.S. Department of Housing and Urban Development and U.S. However, permits for future construction recorded a 4.4% Could multifamily construction stall? Census Bureau data. below the September 2022 rate of 1,463,000.

Let's personalize your content