Housing market “stuck” as mortgage rates remain above 7%

Housing Wire

SEPTEMBER 7, 2023

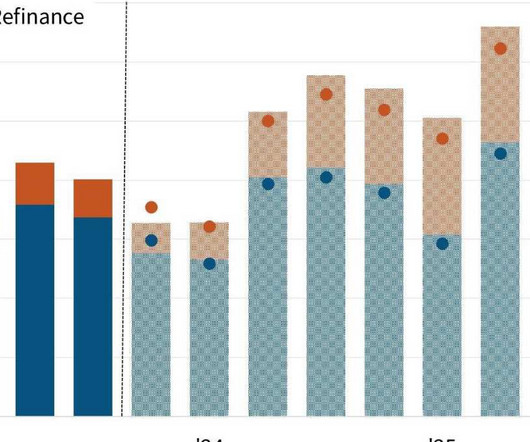

A slight cooling in mortgage rates wasn’t enough to keep mortgage applications from sinking to a 28-year low. Freddie Mac‘s Primary Mortgage Market Survey, which focuses on conventional and conforming loans with a 20% down payment, shows the 30-year fixed rate averaged 7.12% as of Sept.

Let's personalize your content