Do Appraisal Gap Clauses Impact Appraisals?

Cleveland Appraisal Blog

JULY 20, 2022

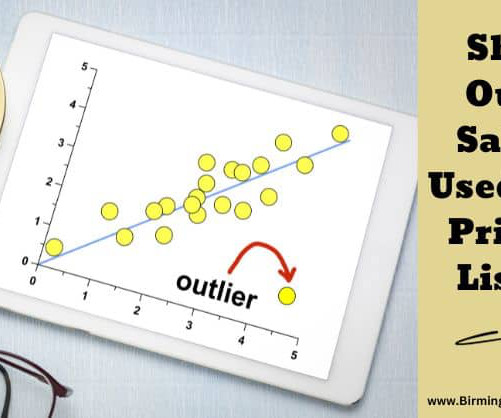

An appraisal gap clause can be written into a contract. It states that the buyer will still purchase the home at the contract price, even if the appraised value is lower than the contract price by a certain amount. These will likely begin to become less common as the market cools off. But not always.

Let's personalize your content