Altos: Sellers are coming back to the housing market, can buyers keep up?

Housing Wire

FEBRUARY 12, 2024

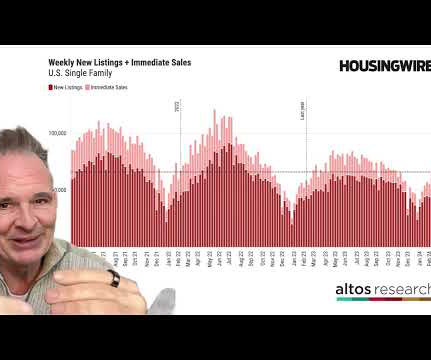

But home sellers are gradually easing back into this housing market. Any time inventory rises, you start to see housing crash hyperbole on social media. There were 66,000 new listings this week, of which 14,000 are already in contract. Sellers are coming back to this housing market.

Let's personalize your content