The worst for mortgages may be over, but younger borrowers still face affordability challenges

Housing Wire

FEBRUARY 12, 2024

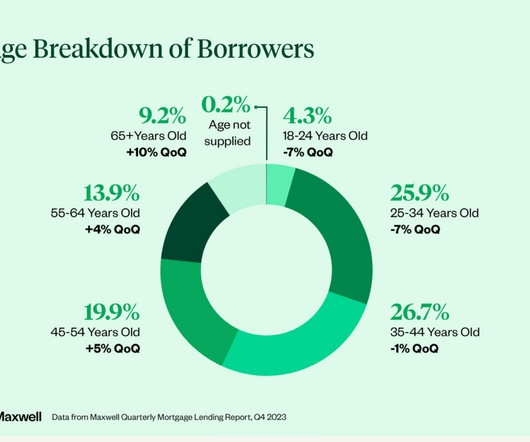

The worst times for mortgage originations may be over as the market appears to be turning, but it’s still an unaffordable environment for younger borrowers in particular, according to a fourth-quarter 2023 lending report from Maxwell. If home prices and lending costs moderate in 2024, significant demand could flow into the market.

Let's personalize your content