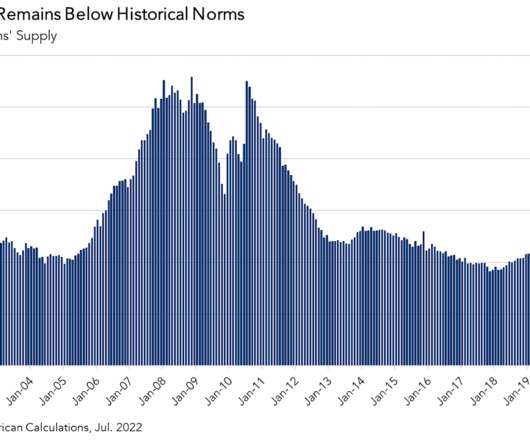

How the housing market will evolve in 2023

Housing Wire

JANUARY 25, 2023

This article is part of our 2022 – 2023 Housing Market Update series. They increased the Federal Funds Rate from nearly 0% at the start of 2022 to 4.5% in December 2022, its highest level since 2007 and its fastest rise in more than 40 years. As inflation eases, so will long term mortgage rates. They eased below 6.5%

Let's personalize your content