Housing inventory fell last week, but it won’t derail the spring bump

Housing Wire

APRIL 6, 2024

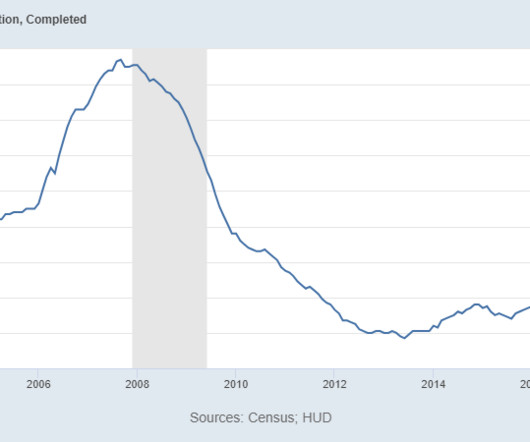

Weekly housing inventory data — both active inventory and new listings — are prone to one-week moves that deviate from a trend, especially if people are going Easter egg hunting. But, despite the weekly moves, the one bright spot for housing is that housing inventory is growing on a year-over-year basis.

Let's personalize your content