The opportunity cost of modern-day redlining

Housing Wire

APRIL 9, 2024

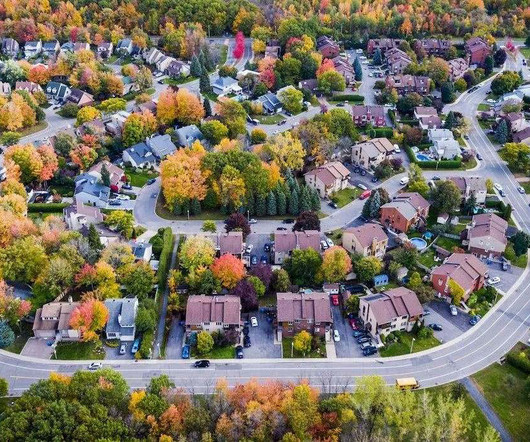

Modern-day redlining persists, and it’s costing lenders millions in legal fees. For example, since home appraisals consider trends in past property values, BIPOC neighborhoods may be considered “risky” due to historic segregation and the cumulative effects of chronic underinvestment. From 2020 to 2030, the Urban Institute projects 8.5

Let's personalize your content